Acadlore takes over the publication of JCGIRM from 2022 Vol. 9, No. 2. The preceding volumes were published under a CC BY license by the previous owner, and displayed here as agreed between Acadlore and the owner.

Performance of State Owned Electric Utilities – Case of Bosnia and Herzegovina, Slovenia and Croatia

Abstract:

One of the biggest questions battling governments is performance of Electric Utilities, as they are one of the biggest resources and largest State Owned Enterprises. This issue became more important as electricity market has been liberalized and fully opened. Before market liberalization state owned Electric Utilities operated in monopoly market where competition was not possible. Therefore, due to market liberalisation existing companies have to be more competitive than before in order to grow and survive new competition from EU countries. Paper analyses performance of State Owned Electric Utilities from Bosnia and Herzegovina, Slovenia and Croatia. Measuring the success of the State Owned Electric Utilities is based on the analysis of financial statements for period from 2008 to 2012, using indicators of profitability. Electricity market in Slovenia and Croatia have been fully opened in analyzed period while electricity market in Bosnia has been closed. The results reveal that State Owned Electric Utilities operating in opened market have better performance and are more competitive than State Owned Electric Utilities which operate in closed market. The broad conclusion that emerges from the results is that market opening and new competition entering markets has pushed companies to improve their governance practices and performance in order to survive on the market.

1. Introduction and Literature Review

Performance of State owned electric utilities are essential for the reform of the electricity sector in every country. One of the biggest questions battling governments is performance of Electric Utilities, as they are one of the biggest resources and largest State Owned Enterprises. This issue became more important as electricity markets have been liberalized and fully opened and all customers have the ability to freely choose their supplier of electricity. Before this state owned Electric Utilities operated in monopoly market where competition was not possible.

Based on Law on Transmission of Electric Power, Regulator and System Operator in BIH the State Electricity Regulatory Commission of Bosnia and Herzegovina has passed decision on scope, conditions and time schedule of the electricity market opening in Bosnia and Herzegovina. This decision, made in 2006, has proposed steps and flow of electric market opening in Bosnia and Herzegovina. The electricity market opening had proceeded gradually, and the main aim of the opening is the creation, maintenance and development of competitive conditions among participants in the electricity market. Therefore, existing companies will need to be more competitive than before in order to grow and survive new competition from neighbouring countries and EU.

Electricity market opening in Bosnia and Herzegovina was implemented in accordance with the time schedule according to which the eligible customer status may be acquired.

- as of January 1, 2007, all customers with annual consumption of electricity higher than 10 GWh,

- as of January 1, 2008, all customers with annual consumption higher than 1 GWh,

- as of January 1, 2009, all customers except households, and

- as of January 1, 2015, all electricity customers.

The Slovenian energy market structure has been to a large extent State owned and competition and choice for consumers remained moderately limited for number of years. Both electricity and gas industries has been 100% open to competition from 1 July 2007 (ECOTEC Research & Consulting, 2007).

The electricity market in Croatia has been fully open to all customers as of 1st July 2008, though as a practical matter, the former vertically integrated utility, Hravtska Eleckroprivreda (HEP), remains the only supplier of electricity in the country and is the primary importer of electricity (with electricity imports around 36%) (European Bank for Reconstruction and Development, 2012)

There are numerous reasons for establishing or retaining public enterprises, especially if we consider resources that are very important for country, society and from witch most of the government budget is financed. Jones and Mason (1982) categorized as follows: ideological predilection, acquisition or consolidation of political or economic power, historical heritage and inertia, and pragmatic response to economic problems. Friedmann and Garner (1970) also used four categories: promotion and acceleration of economic development, defensive reasons, controlling monopoly industries, and political ideology. Peterson (1985) argued that SOEs are established to pursue national goals, economic efficiency, weakness of the POEs, and political ideology.

SOEs have been driving force for development and growth of many countries. However, in the realm of public policy, one of the most unprecedented global features in the last quarter of the twentieth century has been privatization. During the period, governments all over the world introduced various forms of privatization irrespective of their economic context, political orientation and ideological position (Haque, 2000). There are different views of privatization and its effects on performance of companies as well as on benefits of privatization for country and its economic growth. One group of authors support privatization and argue that it has positive impacts on company performance and country’s economics development (Magginson and Netter, 2001; Vickers and Yarrow, 1995; Dewenter and Malatesta, 2001; D’Souza and Megginson, 1999 and others). On the other hand, other group of authors does not support privatization of strategically important enterprises and argue that privatization has negative impacts country’s economics development and growth (Campbell-White and Bhatia, 1998; Bayliss, 2002 and others).

While Bozec, R., Breton, G. and Côté, L. (2002) in its research of state–owned enterprises and private firms for the period 1976–1996 argue that state owned enterprises “when their main goal is to maximize profit, perform as well as the privately owned enterprises. Therefore, the alleged under–performance of the state–owned enterprises may only be the result of pursuing other goals.”

Despite all these arguments most of the countries around the world have kept its Electric Utilities under the government ownership in full or partial control. Reason for this is that Electric Utilities are of great importance for economic prosperity of every country and they are often one of the biggest resources and largest State Owned Enterprises. Therefore, its performance and competitiveness is very important especially when electricity market has been liberalized and fully opened for new competition.

2. Methodology and Research Hypothesis

Paper analyses performance of State Owned Electric Utilities from Bosnia and Herzegovina, Slovenia and Croatia. To understands difference in performance of State Owned Electric Utilities in region and impact of electricity market opening we have conducted a comparison analysis of performance of companies from Bosnia and Herzegovina, Slovenia and Croatia. As Slovenian and Croatian electricity market has been fully opened in analysed period their State Owned Electric Utilities have been operating in competitive market where competitors from EU companies are free to enter.

Measuring the success of the State Owned Electric Utilities is based on the analysis of financial statements for period of five years, from 2008 to 2012, using indicators of profitability. In order to measure performance of these companies we have defined Key Performance Indices (KPIs).

Key Performance Indices are as following:

1. Return on Equity (ROE)

2. Return on Assets (ROE)

3. Operating Margin

4. Net profit Margin

5. Equity Ratio

6. Sales/Total Asset Ratio (S/T)

7. Net income per employee

Performance data will be gathered for sample of 12 State Owned Electric Utilities from Bosnia and Herzegovina, 9 State Owned Electric Utilities from Slovenia and 1 State Owned Electric Utilities from Croatia (as HEP Group it is only State Owned Electric Utilities operating in Croatia). HEP Group (Hrvatska elektroprivreda d.d.) is comprised of 13 fully owned companies and 3 companies with 50% ownership.

The research data was gathered from companies’ annual reports, the database of the Banja Luka Stock Exchange and the Sarajevo Stock Exchange, the Agency of the Republic of Slovenia for Public Legal Records and Related Services (AJPES), the Zagreb Stock Exchange, Croatian Energy Regulatory Agency (HERA) and companies’ web pages.

To offer useful answers to the research problem and realize the study objectives, the following hypotheses were tested:

H1: Market opening has positive impact on performance and competitiveness of State Owned Electric Utilities as new competition entering markets has pushed companies to improve their governance practices and performance.

H2: State Owned Electric Utilities operating in opened market have better performance and are more competitive than State Owned Electric Utilities which operate in closed market.

3. Results and Discussion

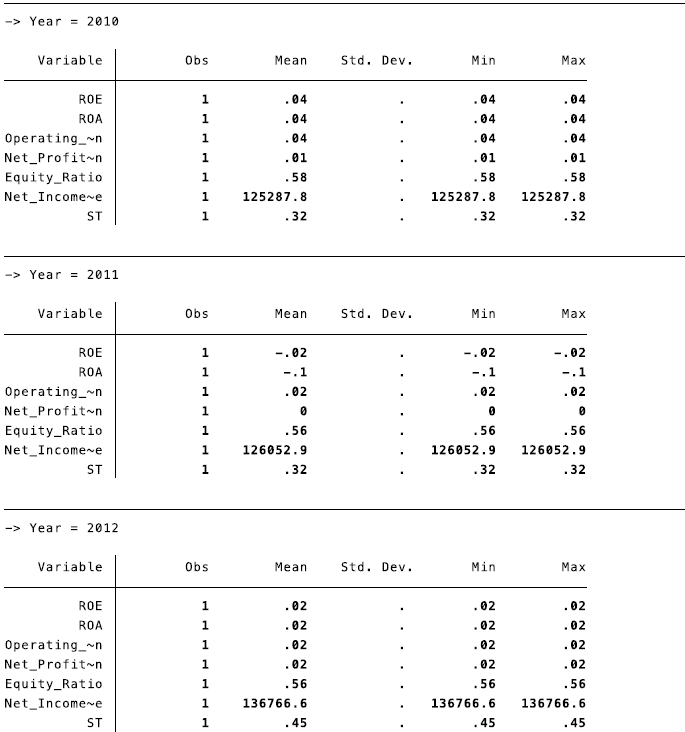

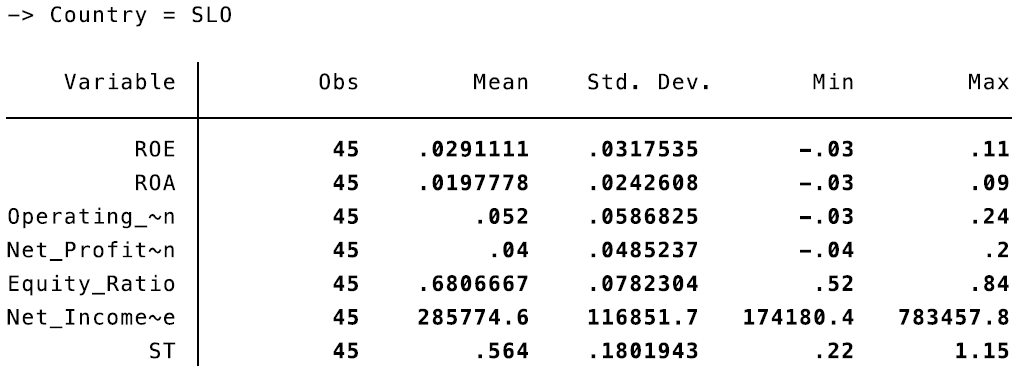

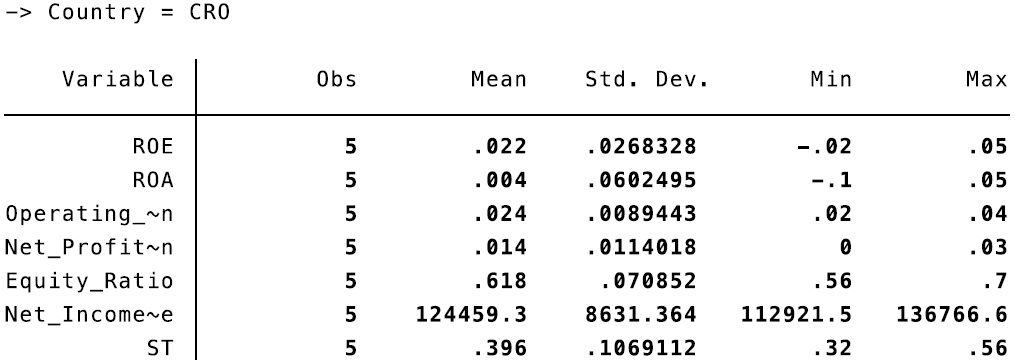

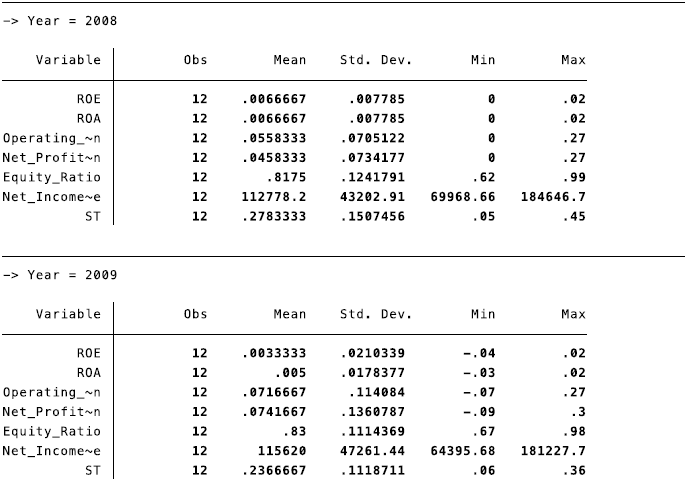

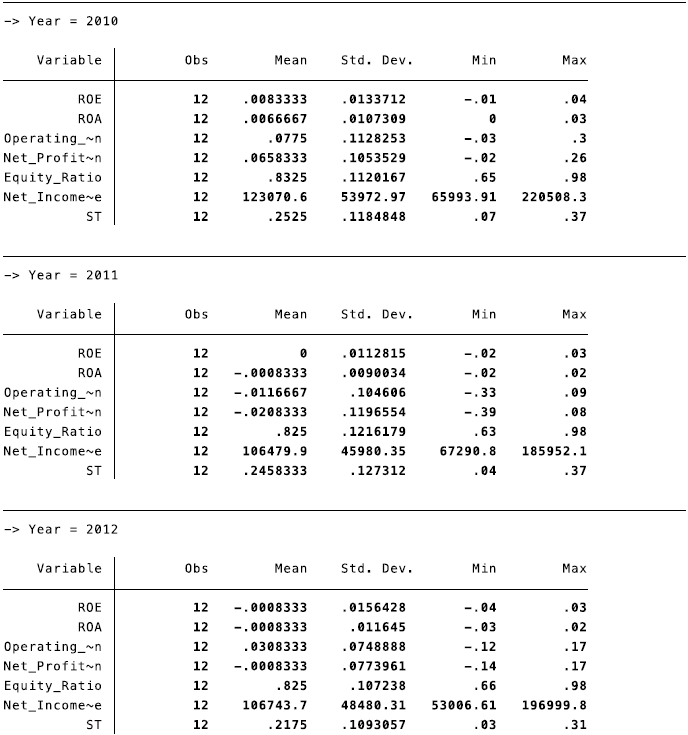

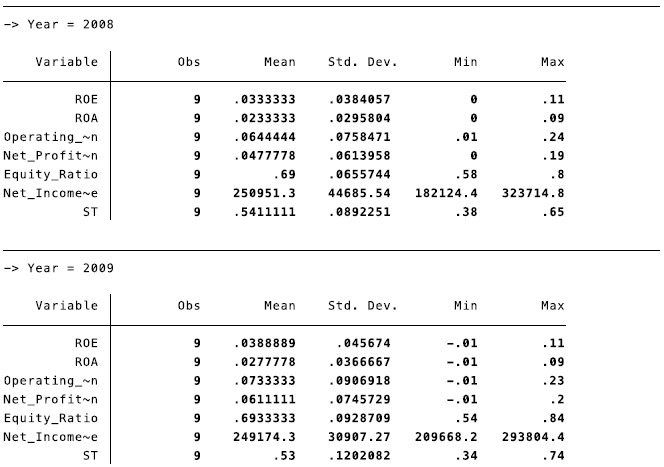

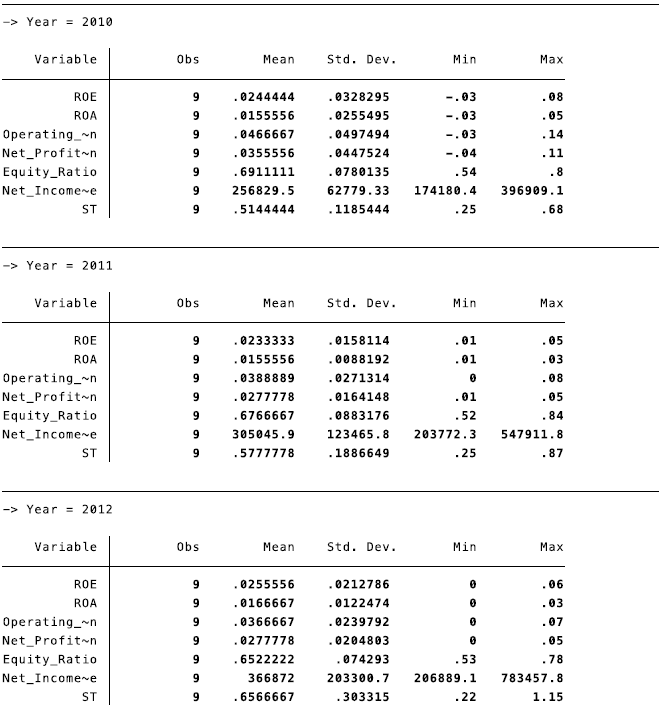

Research data acquired for 12 Bosnian, 9 Slovenian and 1 Croatian State Owned Electric Utilities were analysed according to Key Performance Indices. Table 1, 2 and 3. presents descriptive statistics of Key Performance Indices for Bosnian, Slovenian and Croatian State Owned Electric Utilities in cumulative amount for period from 2008 to 2012.

Figure 1. indicates that State Owned Electric Utilities from countries with opened electricity market have on average higher Return on Equity than State Owned Electric Utilities from countries with closed electricity market. Moreover, State Owned Electric Utilities from Bosnia and Herzegovina have negative trend and constant decrease in ROE in analysed period. This shows that companies from Bosnia and Herzegovina are less efficient in using shareholders’ capital in generating profits.

Figure 2. shows that State Owned Electric Utilities from Bosnia and Herzegovina have significantly lower Return on Asset than State Owned Electric Utilities from Slovenia and Croatia and negative trend and constant decrease in ROA in analysed period. This shows that companies from Bosnia and Herzegovina are less efficient in utilization of its assets, which is one of the most important factors in Electric Utilities. Croatian HEP Group has accounted loss only in 2011. Due to unfavourable hydrological conditions they needed to increase imports of electricity (at higher price) and despite growth in operating income they had has accounted losses (HEP Group, 2012).

Data from Figure 3. and Table 1,2 and 3. shows that in analysed period State Owned Electric Utilities from Bosnia and Herzegovina on average have Operating Margin of 4.54%, State Owned Electric Utilities from Slovenia have Operating Margin of 5.23% and State Owned Electric Utilities from Croatia have Operating Margin of 2.33%. This results indicates that Bosnian companies have slightly lower Operating Margin and in certain periods are less profitable than Slovenian companies, while Croatian companies have lowest Operating Margin of analysed countries.

Similar situation is with Net Profit Margin of analysed State Owned Electric Utilities. Data from Figure 4. and Table 1. shows that in analysed period State Owned Electric Utilities from Croatia have lowest Net Profit Margin. Net Profit Margin of Croatian State Owned Electric Utilities indicates that they are less profitable and less efficient in converting revenue into actual profit. Moreover, it shows that they have poorer control over its costs compared to Slovenian State Owned Electric Utilities. State Owned Electric Utilities from Bosnia and Herzegovina have negative trend of Net Profit Margin in analysed period.

Figure 5. shows larger percentage of assets of State Owned Electric Utilities from Bosnia and Herzegovina are financed/owned by shareholders, which is not the case in State Owned Electric Utilities from Slovenia and Croatia where almost half of assets are financed by debt. Bosnian State Owned Electric Utilities have not had large investments in asset and therefore did not require large financing. This high Equity Ratio shows that Bosnian State Owned Electric Utilities have been largely financing its assets by its equity and it means that they will be able to processed with future investment projects and they do not have large obligations to its creditors.

Analysis of indicate that in analysed period State Owned Electric Utilities from Bosnia and Herzegovina have significantly lower Net Income per employee than State Owned Electric Utilities from Slovenia and slightly lower Net Income per employee than State Owned Electric Utilities from Croatia. Moreover, Bosnian Electric Utilities have negative trend and constant decrease of Net Income per employee in analysed period, while Slovenian and Croatian Electric Utilities have positive trend and constant increases of Net Income per employee. This shows that managers of Bosnian State Owned Electric Utilities do not have ability to use their human resources efficiently to create profits for company. Furthermore, this indicates overemployment in Bosnian State Owned Electric Utilities.

Data from Figure 7. shows that in analysed period State Owned Electric Utilities from Bosnia and Herzegovina considerably lower S/T ratio than State Owned Electric Utilities from Slovenia and Croatia. Again, results indicate negative trend in S/T ratio for Bosnian companies in analysed period. Therefore, Bosnian State Owned Electric Utilities are not efficient in managing assets at its disposal to generate sales revenue. Higher S/T ratio of Slovenian and Croatian State Owned Electric Utilities suggests that they require much smaller investment to generate sales revenue and, therefore, have higher profitability.

4. Conclusion

Issue of performance and competiveness of State Owned Electric Utilities is of great importance, specially when electricity market is fully opened and as State Owned Electric Utilities no longer operated in monopoly market where competition was not possible.

Thought analysis of sample companies it can be concluded that Bosnian State Owned Electric Utilities are not well governed and that government is not doing much to change situation in these companies. Moreover, big problem presents overemployment, which is also result of poor governance of these companies and not including experts in boards and top management positions in companies.

In period after electricity market opening in Slovenia and Croatia there has been a steer towards lower employment rates in order to achieve more efficient economic operations and optimize business processes. Moreover, Slovenian and Croatian State Owned Electric Utilities had positive trend in most of KPI’s in period after electricity market opening. This also needs to be one of primary goals of Bosnian government and government should learn lessons from its neighbouring countries whom already went trough this process.

The results reveal that State Owned Electric Utilities operating in opened market have better performance and are more competitive than State Owned Electric Utilities which operate in closed market. The broad conclusion that emerges from the results is that market opening and new competition entering markets has pushed companies to improve their governance practices and performance in order to survive on the market.

Annex 1. Descriptive statistics of KPIs per year for Bosnian State Owned Electric Utilities

Annex 2. Descriptive statistics of KPIs per year for Slovenian State Owned Electric Utilities

Annex 3. Descriptive statistics of KPIs per year for Croatian State Owned Electric Utilities