Acadlore takes over the publication of JCGIRM from 2022 Vol. 9, No. 2. The preceding volumes were published under a CC BY license by the previous owner, and displayed here as agreed between Acadlore and the owner.

Capital Flight and Unemployment in Nigeria: An Empirical Investigation

Abstract:

The growth rate of unemployment in Nigeria is becoming an issue of great concern therefore calling the attention of stake holders to seeking solution to it. On the other hand, capital flight is another issue that has generated great concerns among economists with regards to its growth over the decades particularly in developing countries of which Nigeria is one on the top of the list as shown in the literature. Given these, it is highly essential that the attendant effects of this incredible growth of capital flight are found, however some of these effects are already mentioned in the literature. Given the growth rate of unemployment in Nigeria and the failure of many policies prescribed by the government of Nigeria to curb it, it has therefore become very clear that there are still more factors contributing to unemployment than the ones known. Solving the unemployment problem demands the knowledge of all factors contributing to it. In this paper, capital flight is identified as one of the factors contributing to unemployment in Nigeria. The Ordinary Least Squares Method including Co-integration and Error Correction Mechanism (ECM) were used to investigate this assertion. It was found that in the short run, capital flight contributes positively to unemployment in both current and next years while in the long run, it only contributes positively in the current year while contributing negatively in the next year but leaving an unemployment gap as the contribution of the current year is greater than that of the next year.

1. Introduction

The outflow of capital from developing countries has increased greatly over the years particularly in Africa. This is becoming a big problem and it is generating serious concerns as it has made Africa a ‘net creditor’ to the rest of the world as shown by Ndikumana and Boyce (2001). A recent study produced by Global Financial Integrity (GFI) estimates illicit financial flows out of all developing countries at $858 billion to $1.06 trillion a year (Kar and Cartwright-Smith, 2010).

The size of capital flight in developing countries is assuming a serious dimension and posing huge threat to sustainable growth especially in Africa (Ayadi, 2008). Africa lost about USD 700 billion between 1970 and 2008 as a result of capital flight. If flight capital had been reinvested in Africa with the same level of productivity as that of actual investment, estimates presented in this report suggest that the rate of poverty reduction could have increased 4-6 percentage points a year, on average, over the period from 2000 to 2008 (African Economic Outlook, 2012). The enormity of such a huge outflow of illicit capital explains why donor-driven efforts to spur economic development and reduce poverty have been underachieving in Africa (Kar and Cartwright-Smith, 2010).

Group | Total IFFs | ||||

1970s | 1980s | 1990s | 200-2008 | 1970-2008 | |

Africa | 57,291 | 203,859 | 155,740 | 437,171 | 854,061 |

North Africa | 19,161 | 72,020 | 59,813 | 78,742 | 229,737 |

Sub-Saharan | 38,130 | 131,839 | 95,927 | 358,429 | 624,324 |

Horn of Africa | 2,354 | 14,131 | 5,108 | 15,603 | 37,197 |

Great Lakes | 6,925 | 16,079 | 4,978 | 10,285 | 38,267 |

Southern | 5,894 | 20,581 | 31,447 | 116,828 | 174,751 |

West and Central | 22,956 | 81,047 | 54,394 | 215,712 | 374,109 |

Fuel-exporters | 20,105 | 67,685 | 48,157 | 218,970 | 354,917 |

Nonfuel-exporters | 7,867 | 26,517 | 22,375 | 23,342 | 80,102 |

Table 1 above showed a detailed account of the illicit financial flow from Africa: Africa lost \$57,291 million in the 1970s, \$203,859 million (an increment above 100%) in 1980s, the amount reduced to \$155, 740 million in the 1990s and has increased greatly to \$437,171 million as at 2008.

The proportion of the Sub-Sahara African (SSA) countries is enormous. This actually has generated serious concerns about the region. Sub-Sahara African countries had 66.55%, 64.67%, 61.59% and 81.99% proportions in 1970s, 1980s, 1990s and 2000-2008 respectively. It had a total of 73.10% proportion in the total sum of illicit financial flows during the periods 1970-2008. Ndikumana and Boyce(2012) reported that capital flight has become a chronic problem in the region. Between 1970 and 2010 total capital flight from the 33 SSA countries covered in this report amounts to \$814.2 billion in constant 2010 dollars. These countries lost \$202.4 billion between 2005 and 2010 alone.

This has great attendant effects on the economies of the affected countries. As noted by Herkenrath (2013), the Organisation for Economic Co-operation and Development (OECD) puts it, IFF “strip resources from developing countries that could be used to finance much-needed public services, from security and justice to basic social services such as health and education, weakening their financial. Debt burdens, poor wealth distribution, scarce of resources for domestic investments and productive activities are also part of the effects mentioned {see Fofack and Ndikumana(2010), Boyce and Ndikumana(2010,2011,2012)}

The table below shows the capital flight of 33 SSA countries as computed by Ndkumana and Boyce(2012) for the years 1970-2010.

Country | Total Capital Flight (billion, constant 2010 $) | Unemployment | |

1. | Nigeria | 311.4 | 23.9%(2011) |

2. | Angola | 84.0 | 26%(2013) |

3. | Cote d'Ivoire | 56.0 | 15.7%(2008) |

4. | South Africa | 38.5 | 24.4%(2012) |

5. | Sudan | 38.4 | 20%(2012) |

6. | Congo, Democratic Republic | 33.9 | 46.1(2013) |

7. | Gabon | 25.5 | 16%(2010) |

8. | Ethiopia | 24.9 | 17.5%(2012) |

9. | Mozambique | 20.7 | 17%(2007) |

10. | Cameroon | 20.0 | 13.5%(2012) |

11. | Congo, Republic | 19.9 | 25%(2012) |

12. | Zimbabwe | 18.3 | 95% (2009) |

13. | Zambia | 17.3 | 14%(2006) |

14. | Tanzania | 14.7 | 10.7%(2010) |

15. | Ghana | 12.4 | 12.9%(2005) |

16. | Madagascar | 11.7 | 3.8%(2010) |

17. | Sierra Leone | 10.0 | 3.4%(2004) |

18. | Rwanda | 9.3 | 3.4%(2012) |

19. | Uganda | 8.4 | 4.2%(2010) |

20. | Burundi | 6.9 | 35%(2009) |

21. | Kenya | 4.9 | 40%(2011) |

22. | Seychelles | 4.6 | 3.3%(2013) |

23. | Cape Verde | 3.9 | 10%(2013) |

24. | Botswana | 3.8 | 7.5%(2007) |

25. | Mauritania | 3.1 | 30%(2008) |

26. | Central African Republic | 2.7 | 16.1%(2005) |

27. | Chad | 1.6 | 22.6%(2006) |

28. | Guinea | 1.6 | 22.3%(2009) |

29. | Burkina Faso | 1.5 | 77%(2004) |

30. | Malawi | 1.4 | 3%(2011) |

31. | Sao Tome And Principe | 1.1 | 13.8%(2013) |

32. | Lesotho | 1.0 | 45%(2002) |

33. | Swaziland | 1.0 | 40%(2006) |

Total 33 countries | 814.2 | 7.5%(2012) |

* The bracket beside the unemployment rate indicates the year the data was reported.

The table also shows the unemployment rate of the countries. It is sad that most of the countries do not have up to date statistical records. However, it could be seen that the first fifteen countries on the table had unemployment rate above 10%. This may make one to ask: does capital flight contributes to unemployment? If it does, in what way does it contribute, positively or negatively?

The objective of this paper is to show empirically if capital flight has a significant impact on unemployment rate. Nigeria will be used as a case study. Therefore, the scope of this paper is limited to Nigeria only and the data that will be used will range from 1980-2013.

This paper is therefore divided into the next following sections, first is the review of related literatures, the theoretical review after which is the unemployment situation in Nigeria then a discussion on the measurement of capital flight, the methodology, discussion of findings policy implications and conclusion.

2. Literature Review

This chapter discusses relevant literature on capital flight, its determinants and how it affects an economy.

Capital flight has been said to be a major cause for high indebtedness of developing countries. Ajayi(2005) noted that when resources are being lost in the form of capital flight, there are several long-term effects. The first is that the availability of resources for domestic investment is reduced. The rate of capital formation is reduced by capital flight and this adversely affects the country's current and future prospects. Income that is generated abroad as well as wealth held abroad are outside the purview of relevant authorities and cannot be taxed. The resulting effects are a reduction in government revenue and its debt servicing capacity. Therefore, it appears a meaningful resolution of the African debt crisis might involve the arrest of capital flight from Africa (Jimoh, 1991).

On the determinants of capital flight in Nigeria, if an opinion poll is to be conducted majority of Nigerians would say corruption. This is as a result of the high corruption perception in Nigeria. However, beyond opinion polls, economists have identified corruption as one of the factors causing capital flight (Jimoh, 1991;Ajayi, 2005;adetiloye, 2012; Quan and Meenakshi, 2006; Gerald, 2005; Ndikumana and Boyce, 2001; Valerie, et. al., 2005). However corruption is a non-economic variable and its measurement might be challenging. Jimoh(1991) however measured it by using the number of persons convicted and sentenced to prison for offences related to primitive capital accumulation. Using an Ordinary Least Squares(OLS) method of estimation, Quan and Meeknakshi concluded that a positive relationship exists between corruption and capital flight. Another non economic variable is political instability and this has been proven to affect capital flight as corruption.

Schneider(2003) identified inflation as one of the asymmetric information and risk that causes capital flight. Ajayi(1995) noted that when a rising fiscal deficit is financed through the printing of money, it leads to inflationary pressure. To avoid the erosion of their monetary balances by inflation, moving out of domestic assets is one way of avoiding inflation tax. When fiscal deficit is financed through bond sales, domestic residents may expect that at some future date their tax liabilities may increase to pay for the national debt. This would encourage domestic investors to move their assets to foreign countries to avoid potential tax liabilities. Two major works are noted here: firstly, Jimoh(1991) used OLS method to test the impact of difference in domestic and foreign inflation on capital flight, and Li(2012) used the same method of estimation but tested the impact of change in domestic inflation on capital flight. Both of them concluded that there is positive relationship. Davies(2007) likewise stated that low inflation helps to curb capital flight in post-conflict economies by using a panel data set for 77 countries.

Another key determinant is the exchange rate. Schneider(2003) also recognised exchange rate depreciation as an asymmetric risk that affects capital flight. Jimoh(1991) tested the impact of exchange rate over valuation on capital flight. He measured the over valuation as the difference between the effective nominal exchange rate and the trend value of exchange rate. He concluded that a positive relationship exist between capital flight and exchange rate over valuation. Ayadi(2008) also tested the impact of exchange rate which he measured as an average of the yearly exchange rate on capital flight. He concluded that exchange rate depreciation increases capital flight. However Valerie, et. al. (2005), Akanni(2007) and Ajilore(2010) have argued that the value of the external debt be adjusted to changes in the exchange rate.

Ayadi(2008) also showed that interest rate attractiveness causes capital flight. He did this by testing the impact of interest rates differential on capital flight. He concluded that a negative relationship existed among the two. He measured interest rates differential as a difference between domestic short term rate and the United States’ 3-month Eurodollar rate (or Nigeria’s short term rate minus the US 3-months Eurodollar rate). However, Jimoh(1991) showed that interest rate differential is not a major determinant as it was not significant. It is of much concern anyway to draw a conclusion from the research work as the stationarity tests were not carried out on the variables tested.

On the effects of capital flight, Ndikumana and Boyce(2012) identified six effects of capital flight:

First, by draining valuable national resources, capital flight widens the resource gaps faced by these countries, perpetuating their dependence on external aid. Moreover, by deepening the resource gaps, capital flight slows down capital accumulation and long-run growth.

Second, capital flight frustrates African countries’ efforts to increase domestic resource mobilization. It erodes the tax base and public expenditure through illicit transfer of private capital abroad, tax evasion and tax avoidance by individuals and companies, and outright embezzlement of government revenue by corrupt officials. These perverse effects force governments to incur further debts, part of which ends up fueling more capital flight.

Third, by draining government revenues and retarding growth, capital flight undermines the poverty reduction agenda.

Fourth, capital flight is both a symptom and an outcome of governance breakdown in source countries as well as in the international financial system. It is a result of corruption, dysfunctional regulation and weak enforcement of rules.

Fifth, capital flight worsens income inequality and it has important social and equity implications. Insofar as the perpetrators of capital flight, tax evasion and tax avoidance are the economic and the political elites, capital flight makes tax incidence more regressive in that wealthy residents incur relatively smaller tax burdens than would otherwise be the case.

Finally, capital flight has important political economy implications for the distribution of power. The political elites are able to consolidate power by financing their oppressive machinery with illicit wealth. As a result, capital flight strengthen dictatorships and provides the means to perpetuate autocratic regimes, as evidenced by the cases of Mobutu in the former Zaïre and the various military dictatorships in Nigeria, Gabon, and Equatorial Guinea.

Furthermore, Herkenrath(2012) identified some social and political implications of capital flight: first is undermining of necessary political changes, secondly, eroding of good governance and distortion of economic policy and also weakning of social and political stability in developing countries.

The impact of capital flight on economic growth has been tested empirically (see Adaramola and Obalade, 2013; Umoru, 2013; Kolapo and Oke, 2012; Otene and Edeme, 2012 and Njimated, 2008).

Two major works are worthy of noting here: Njimated(2008) used Two-Stage Least Squares method to investigate the impact of capital flight on economic growth in Cameroon, likewise, Otene and Edeme did the same for Nigeria using the same method. They both concluded that capital flight has a negative impact on economic growth.

More to the effects, Lin and Wang(2004) tested the relationship between capital outflow and unemployment in the G-7 countries. They specified the model using FDI outflow and Outflow portfolio investment as the independent variables. They concluded that the outflow FDI reduces unemployment in home countries however the portfolio investment was insignificant in all countries but US where it shows a positive relationship with unemployment.

Lin and Wang(2008) also used panel data to test the relationship between capital outflow and unemployment for 33 countries. They concluded that a positive relationship existed among outflow FDI, outflow portfolio and unemployment.

The impact of capital flight on unemployment has not been clearly shown empirically in the literature. However most of them have shed lights on how capital flight affects unemployment in developing countries.

Given the above, the objective of this paper is to show empirically, the impact of capital flight on unemployment using Nigeria as a case study. This paper tends to answer the following research questions:

i. What is the relationship between capital flight and unemployment?

ii. Does capital flight has a significant impact on unemployment?

The theory on the relationship between capital flight and unemployment may not have been explicitly shown. However, the problem of capital mobilisation in developing countries could serve as a basis for this discussion.

Developing countries have been said to have slower growth rate, high level of poverty, low standard of living, unemployment among other problems as a result of low capital formation. (see Hayami and Godo, 2005:43-45; Agarwal, 1996:7-9). It all start from low income, to low savings, to low capital formation then to low standard of living and then back to low income. This movement is termed the vicious circle of poverty (see Jhingan, 2008).

Loans and grants are being given to developing countries so as to improve domestic capital formation, increase domestic investments and thereby reduce unemployment rate. When capital formation increases, investment is expected to increase leading to reduction in unemployment.

Capital flight competes with domestic investment as it reduces capital formation thereby leading to increase in unemployment rate.

The major problem here is the loans and grants given to developing countries especially the SSA countries including income generated from the natural resources in these countries which could aid the reduction of unemployment have been lost due to capital flight.

One of the major problems Nigeria is faced with currently is unemployment. From available data, it is clearly shown that unemployment rate has been on an increasing trend. According to National Bureau of Statistics (NBS), the 2011 Annual Socio-Economic Report gave an unemployment rate of 24% compared to 21% in 2010. The unemployment rate was higher in rural areas (26%) than urban areas (17%). An average of 1.8 million people has entered the active labour market every year over the past five years, and the system has not been able to absorb these numbers (African Economic Outlook, 2012). Even though the official estimates of unemployment in Nigeria are not too robust, and they contradict the general opinion about the problem, however, they indicate that there have been steady fluctuations in unemployment rate in Nigeria (Osinubi, 2005). Unemployment rate rose from 11.9% in 2005 to 23.9% in 2011. Salami(2013) noted in Doreo Partners(2013), unemployment rate is growing at the rate of 16% per year.

The problem of unemployment becomes disturbing when the youth unemployment is considered. In 2011, 37.7% of Nigerians age 15-24 and 22.4% of those between ages 25-44 that are willing to work cannot find work. On the average, youth unemployment rate in Nigeria was 46.5% in 2011(BGL, 2012). Salami(2013) also noted that Nigeria’s spiralling youth unemployment can be said to have significantly contributed to the dramatic rise in social unrest and crime such as Niger Delta militancy, Boko Haram and the Jos crisis. This was empirically investigated by Torruam and Abur(2014). Using the Granger Causality based on Toda-Yamoto Approach, they concluded that unemployment granger cause crime in Nigeria.

The effect of unemployment is growing beyond crime rates; there have been records of stampede at recruitment centres as a result of large crowds seeking employment whereby some have led to deaths of the job seekers. A recent example is that of Nigeria Immigration Service recruitment exercise.

The Government has at various times and through various schemes ‘preached the gospel’ of self employment and skill acquisitions for youth and graduates. Some of the schemes include National Youth Service Corps (NYSC), National Poverty Eradication Programme (NAPEP), You-Win, etc. However, it seems these are not working.

Defining capital flight is an issue of discussion as its definition depends on the measurement method to be used. However, for a start, it is referred to as the illicit outflow of capital. Nigeria is a leading country in capital flight among other sub-Saharan African countries. Capital flight in Nigeria is more severe than it is elsewhere in other Sub-Saharan Africa countries. Although reliable and comprehensive data does not exist on the magnitude of capital flight from countries of low-income Africa, it is believed that capital flight particularly from Nigeria has been substantial (Saheed and Ayodeji, 2012).

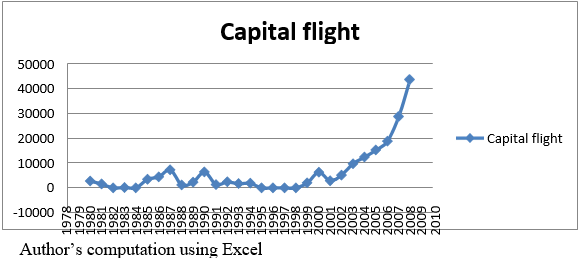

The chart below shows the trend of capital flight in Million US dollars as reported by Kar and Cartwright-Smith(2010): it is shown that capital flight was growing at low rate before year 2000 however, the growth has been increasing incredibly after that period. An average of $15835.4 million was taken out of Nigeria during the years 2000-2009. It grew at an average rate of 32.6% during the period.

Capital flight, largely because of its loose definition, is very difficult to measure (Ajilore, 2010). However in past researches, various methods of measurement have been used. Very common among them are the World Bank(1985), Erbe(1985), Cuddingtion(1986), Morgan Guaranty Trust Company(1986) and Khan(1989).

The World Bank method has however been said to cover capital consisting of private capital outflows of any kind that result in the acquisition of foreign assets by the residents of a country however, it is unable to capture illicit flows generated through the mispricing of trade transactions.(see Kar and Cartwright-Smith(2010) and Ajilore(2010)). Therefore a trade misinvoicing model has been suggested whereby the total import and export discrepancies will be added to the World Bank measure.

The Central Bank of Nigeria has carried out a Survey of Foreign Assets and Liabilities in an attempt at collecting such reliable statistics, and provides additional data for the compilation of the country’s Balance of Payments and International Investment Position statistics. The survey collects data on: Foreign Direct Investment (FDI), Foreign Portfolio Investment (FPI) and Other Capital Flows (OCF) for both inward and outward capital flow in line with international best practice (Mohammed, et. al., 2011). The differences found in the survey are added to the Net Errors and Omissions (NEO) in the Balance of Payments and not only that, also the import and export discrepancies. Since capital flight is essentially concealed, they show up in the error and omissions of the balance of payments entry (Ajayi, 1995). The WB estimates does not use the NEO while some for others it is important (Adetiloye, 2012).

Therefore capital flight is measured here as the addition of NEO to the World Bank Measure.

Where

ΔDebt is Change in External Debt,

FDI is the Net foreign Direct Investment,

CAD is the Current Account Deficit,

ΔFRES is change in Foreign Reserves and

NEO is Net Errors and Omissions.

3. Methodology

Unemployment is said to be influenced by growth rate and can also be influenced via the use of fiscal instruments. Therefore, the model is specified thus:

Where

UNEMt is the unemployment rate at time t,

GRt is the growth rate at time t and

PEt is the Fiscal Instrument at time t.

For the sake of this research, capital flight is introduced and the model becomes:

Where

KFt is the capital flight at time t.

Expressing the model econometrically, it becomes:

Where α is the constant and the βs are the coefficients for the variables with μ representing the error term.

The expected signs are:

$\frac{\partial U N E M t}{\partial G R t}<0$

$\frac{\partial U N E M t}{\partial P E t}<0$

$\frac{\partial U N E M t}{\partial K F t}>0$

The unemployment rate is measured as the proportion of labour force that was available for work but did not work in the week preceding the survey period for at least 39hours; Growth rate is the percentage change in the Real Gross Domestic Product(RGDP) while fiscal instrument is measured as a ratio of total government expenditure to RGDP.

The data used for this research are solely secondary data. The data for public expenditure and the data summed up for capital flight were got from the Central Bank of Nigeria Statistical Bulletin(2012), the data for unemployment were got from the National Bureau of Statistics and the Growth rate were got from the International Monetary Fund as made available on www.indexmundi.com.

4. Estimation and Discussion of Findings

Ordinary Least Squares was the method used in this research. The estimation of equation 4, though the overall significance was good the goodness of fit was not as the R2 was very low. This led to the introduction of the lag of capital flight. Also, in order to correct autocorrelation in the model, both the capital flight and its lag were converted to logarithms. The estimated model is:

Prior to the estimation, Augmented Dickey-Fuller test and Phillips-Perron test were carried out on each of the variables in order to ascertain their order of integration. This is done so as to prevent spurious regression (see Gujarati and Porter, 2009). The tables below show the results:

Variable | Level | First Difference | ||

Intercept | Trend and Intercept | Intercept | Trend and Intercept | |

UNEMt | 0.536142 | 0.536142 | -2.899097* | -3.339996* |

GRt | -2.706428* | -3.013263 | -4.071128*** | -3.983204*** |

PEt | 2.016638 | -1.5042 | -3.469646** | -4.134075** |

KFt | -3.988662*** | -3.918002** | -3.984664*** | -3.830134** |

KFt-1 | -2.737333* | -2.526396 | -4.356232*** | -4.539214*** |

Variable | Level | First Difference | ||

Intercept | Trend and Intercept | Intercept | Trend and Intercept | |

UNEMt | 0.587117 | -1.123318 | -4.833092*** | -5.204681*** |

GRt | -4.074252*** | -4.108793** | -9.530995*** | -9.451519*** |

PEt | 1.266040 | -2.463085 | -8.030472*** | -10.05939*** |

KFt | -2.831418* | -2.801004 | -3.961160*** | -3.764438** |

KFt-1 | -2.060377 | -1.985213 | -5.023404*** | -5.085566*** |

From the above tables, it is revealed that the variables are integrated of order 1 which means they are stationary at first difference.

Eigenvalue | Likelihood Ratio | 5% Critical Value | 1% Critical Value | Hypothesised No. of CE(s) |

0.566113 | 55.51712 | 47.21 | 54.46 | None ** |

0.434399 | 30.46799 | 29.68 | 35.65 | At most 1 * |

0.349476 | 13.37201 | 15.41 | 20.04 | At most 2 |

0.015633 | 0.472694 | 3.76 | 6.65 | At most 3 |

Variable | Coefficient | T-statistic |

C | 0.5406 | 0.5908 |

GRt | -0.1197 | -1.7611* |

KFt-1 | 0.3550 | 2.6240** |

KFt | -0.3395 | -2.6174** |

PEt | 1.5357 | 1.9111* |

R2 = 0.5266 F-statistic = 6.1182*** | ||

Table 5 above shows the result of the estimated model and the long run effects of the independent variables on unemployment. The R2 of 0.5266 shows that the independent variables were able to explain approximately 53% variation in the dependent variable and the F-statistic is significant at 1% significant level implying the overall significance of the model.

From the table also show that if growth rate increases by 1% unemployment will reduce on an average by 0.12%. This is in line with the Okun’s law which states that increase in growth rate will reduce unemployment.

Furthermore, the table shows that the relationship between unemployment and capital flight differs in the long run. The difference in the sign of capital flight and its lag is worthy of note. This implies that on an average a million increase in capital flight will cause unemployment to increase by 0.00355% while the same increment will reduce unemployment in the coming year by 0.00340%. This makes it known that when capital is taken out of the country at a certain period (t-1), unemployment is being increased as a result of shortage of capital for domestic business and investment, this capital is now being invested in a company abroad who uses it to produce goods and then in the coming year (t) sends it to Nigeria to sell. For the successful marketing of the company’s product, some Nigerians will be employed as sales representatives, marketers, etc. However the employment generated by the capital flight of the next year is small compared to the unemployment created by it while it was leaving the country. The unemployment gap is about 0.00015%.

This implies that in the long run there will be a counter effect of capital flight on unemployment particularly in a developing country like Nigeria where imported goods are desired more than domestically produced goods and has most of technological products imported. The openness of the country to imported goods is the gateway by which the counter effect of capital flight will flow into the economy to reduce unemployment. However, this employment generated will be small and be controlled by foreign firms and this could make the employment opportunities created not so pleasing.

However the short run result of the estimated model corresponds to the believed relationship and impact capital flight on unemployment. The table 5 below shows the short run effects of the independent variables on unemployment.

Variable | Coefficient | T-statistic |

C | -0.1301 | -0.4394 |

KFt-1 | 0.3887 | 3.2580*** |

KFt | 0.2525 | 2.3110** |

PEt | 1.9693 | 2.5497** |

ECMt-1 | -0.2471 | -1.7451* |

R2 = 0.6086 F-statistic = 8.1638*** | ||

The parsimonious ECM was used and it shows the rate at which the short run equilibrium is being corrected. The sign of the ECM is negative and it’s significant at 10% significance level. The coefficient of the ECM shows that the discrepancy between the long run and the short run is being corrected at the rate of 25%. More to this, fiscal instrument has a positive impact on unemployment which is contrary to the expected result. It implies that a unit increase in the ratio of government expenditure to RGDP will contribute on an average 1.97% increase to unemployment in the short run. This reveals the impact of the corrupt practises of government office holders on the economy. The bulk of government expenditure in Nigeria has been flown out of the country and invested in foreign firms leading to increase in unemployment in the home country. This is similar to the result got by Osinubi(2005) when he estimated the impact of economic growth on unemployment and poverty.

Furthermore, capital flight and its lag have positive impact on unemployment in the short run. The coefficient of the capital flight shows that a million increase in capital flight will on an average increase unemployment by 0.00253%, the coefficient of the lag shows that on an average, 0.00389% increase in unemployment will further be added in the coming year.

It is also important to note that the growth rate has no effect on unemployment in the short run. This could be the reason for yet high rate unemployment in Nigeria despite the steady economic growth. Some previous researches have wondered the reason for the positive impact on unemployment: it is shown that this may only happen in the short run.

5. Policy Implication

i. The government and the monetary authority must continually find ways of reducing capital flight in Nigeria and this starts with the government office holders as they seem to be the major cause of capital flight from Nigeria.

ii. The insignificance of the impact of the growth are in the short run implies that instead of the government focusing on the growth rate of the economy to reduce unemployment, it should rather focus on reduction of corrupt practises and the encouragement of domestic investment as growth rate has no effect on unemployment in the short run except the long run.

iii. Likewise, it is also shown that fiscal instrument is not bringing out the results it is meant to as a result of the high level of corruption of government office holders and thereby government office holders should become sincere in the service they render to the country.

6. Conclusion

In this paper, the impact of capital flight, fiscal instrument and economic growth on unemployment was tested empirically. The result got showed that capital flight contributes positively to unemployment in the short run however in the long run, it will reduce unemployment a little bit in the coming year leaving an unemployment gap since the increment caused in unemployment by capital flight in the current year is lesser than the reduction it will bring in the next year. The result got also showed that impact of the wide acclaimed economic growth of Nigeria on unemployment will only be seen in the long run implying that the government should focus more on reducing corrupt practises of the government office holders.

The data used to support the findings of this study are available from the corresponding author upon request.

The authors declare that they have no conflicts of interest.