Acadlore takes over the publication of JAFAS from 2023 Vol. 9, No. 4. The preceding volumes were published under a CC BY license by the previous owner, and displayed here as agreed between Acadlore and the owner.

Investment Decision; Information Driven and Preference Ordering

Abstract:

Purpose: The study discussed how cost and character of information, investors’ appreciation of information and the environment synchronized to influence investors preference ordering. It gives insight to the fact that choice of portfolio in investment is not the privy of capital structure and the classical mean-variance efficient analysis theories that see the decision process to be rational. Cost of information, investor characteristics and the environment cannot be treated in isolation but work in tandem for better investment decision. Design/methodology/approach: The Information Driven Efficent Portfolio Model alongside review of the literature were used to analyse how investors bundle of portfolio in a capital structure of a firm, as the dependent variable, is influenced by risk/reward, utility satisfaction, information and its cost of the investor as independent variables. Findings: It is found that there is trade-off between preference ordering (debt and equity) and risk/reward exposure, cost of information as well as information availability of investors in investment decisions. In environments of information asymmetry with uninformed investors in majority, risk is high and preference for debt instrument is equally high. Practicalimplications: Preference ordering,a product of the trade-off, establishes an optional capital structure, but not as determined by management. Investors’ response to the firm’s behaviour promotes the capital structure. Developing the bond market will grow entrepreneurship. Originality/value: The study has characterized; investors and how informed; information design and cost; utility; and investment environment and how they synchronized in responding to behavior in bundling up capitalstructure.

1. Introduction

Suppliers of funds want reward for sacrificing to finance a business. The reward should meet their expectations (Slain, 2002; Eaton, Eaton, Allen, 2005). Classical models have it that the rewards and their expected utilities E (U) are optimized within the bounds of mean-variance efficient portfolios (Livanas, 2008). The investment assets create liability for the firm constituting the financial structure of long term and short term securities financing the total assets. The long term securities, equity and debt capital constitute the capital structure of the firm into the future, with no intention of immediate realization. In the case of equity capital it may travel into perpetuity so long as the company exists and perform satisfactorily, unless a shareholder decides to transfer or liquidate it in a sale. This long term capital is exposed to risk in terms of cash flow from rewards and value of the investment assets. Investors being risk averse may take into consideration all factors that will aid and abet any loss and uncertainties of returns and pay back of invested assets. The reward should go beyond the mean-variance analysis. Investors then analyse the market situation and make the best out of the lot. This assessment can be done when the investor has the relevant information and its cost, relate these to the rate and timing of return to make an informed decision. The uncertainty of the economic environment and its influence on the performance of the firm makes regular receipt of reward and value of assets uncertain. The case of equity is worse for want of contractual right to receive dividend or return (Ross, Westerfield, Jaffe, 2002). In case a firm is liquidated any amount realized is first used to settle statutory debt and other creditors before shareholders are paid the residue if any. This puts the shareholders under serious financial distress. For proponents of capital structure theory, this is a matter of inappropriate composition of the capital structure. The geared firm is seen therefore as susceptible to financial distress. The contemplation is that a geared firm stands at risk of financial distress and be liquidated, without looking at other factors positive of gearing. This poses challenge to businesses which cannot raise and mobilize enough equity funds for their capital requirements, but make do with debt capital. In environments, emerging economies, with weak financial market structure, this pose serious threat to develop the debt market for entrepreneurial initiatives. In such weak environments investors may prefer debt to equity in their preference ordering by not looking at capital structure necessarily. The classical models (Markowitz, 1952, Sharpe, 1964; Fama, 1971, Merton, 1972), construct the efficient frontier (Livanas, 2008) assess the value of the firm through share price behaviour, their mean and standard deviation, as guide to investors in their portfolio ordering. The mean-variance efficient analysis limits the behavioural factors of the potential investor in making his preference ordering. Current developments is directing attention to the behavioural science as a potential driver (Livanas, 2008; Jangogo & Mutswenje, 2014; Shefrin., 2000; Shleifer, 2001; Baberia & Thaler, 2003) but requires better information and education. However, there seem to be lack of such information (Collard, 2009). There are number of challenges that may influence investors and their behaviour including; choice and information overload, unstable or undefined preferences, heuristic decision making, framing effects and investment menu design, procrastination and inertia, and overconfidence (Collard, 2009). It is important to acknowledge and appreciate the need of relevant information and the reaction and behaviour of potential investors towards such information in their investment decision and preference ordering. Mobilization of capital for business operations has been a problem in many an emerging economy. Potential investors are not patronizing the equity market as expected to give businesses the necessary long-term capital. Businesses may then be compelled to rely on debt capital creating the challenge of solvency and liquidity if one considers capital structure theory and gearing. A firm geared has high propensity to be in financial distress (Bodie, Kane & Marcus, 2002; Myers, & Brealey, 2003). Two commercial banks in Ghana; UT and Capital Banks were liquidated under authority of Bank of Ghana, as the regulator, in 2017, for the reasons of liquidity and solvency. Even though UT Bank, one of the affected banks, was listed on the Ghana Stock Exchange, a move to raise more equity funds, it could not survive the threat of the financial distress problem because of low patronage. It should be anticipated that there could be other factors that may cause investors not to prefer equity share capital but choose other financial instruments to satisfy their needs. Understanding the concerns of contributors of capital in this direction can be a positive development. Investors may have their own preferences and choices supported by other factors and available information. Even though capital structure theory is a matter of concern to investors, invariably investors may be influenced by relevant information and cost in directing their behaviour to make their preference ordering. The investors cognitive capacities, information, risk/reward motivation produce preference ordering, as against or juxtapose capital structure, in investment decision. Complementing these issues and factors may help the mobilization of funds for business. It is expected that the work will facilitate the development of the bond market and support start-ups and small businesses to raise enough funds for their activities. The study is presented on; the place of capital structure in portfolio investment decision; choice of portfolio in relation to preference ordering and motivation; relevant information and factors that may influence investors’ decision; the Information Driven Efficiency model; finally the conclusion and recommendations of the study.

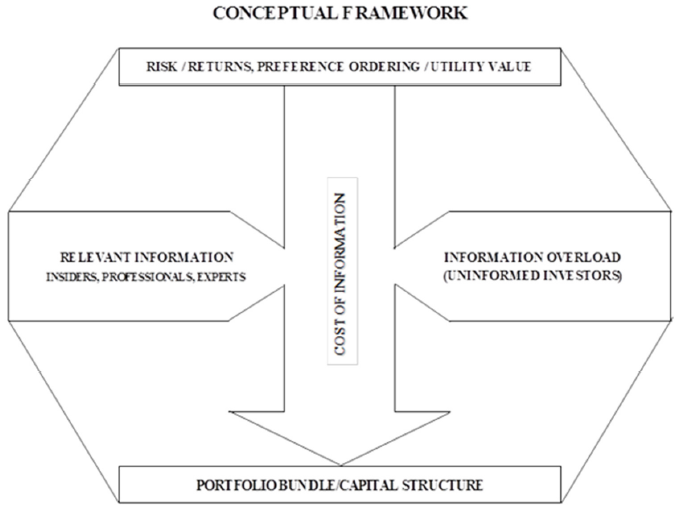

The conceptual framework demonstrates how investors require reward as their satisfaction for accepting risk in financing the business. They make their preference ordering and choice of portfolio influenced by available information and its cost on the performance of the firm. A group of investors may be influenced by relevant information at their disposal whiles others have information overload that dictate their plight. The reaction (behaviour) of investors to the available information results into capital structure of the firm. Capital structure therefore is the response of investors to the characteristics and prevailing circumstances of the firm and not as wished by management.

2. Relevance of Capital Structure

This section discusses the relevance of capital structure in portfolio investment decisions, the risk and reward to the investor, and query whether capital structure causes behaviour or it is the end results of behaviour.

Capital structure of a firm explains how the firm secures and engages long term funds, with different terms and conditions of reward and repayment. It explains how entrepreneurs choose the type, source, and ratio of equity to debt of funding (Hancock, 2009). The theory postulates that debt and equity should be at equilibrium to ensure optimum performance and profitability and to derive some benefits from tax savings over financial distress (Modigliani & Miller 1958). As put by Ross, Westerfield, Jaffe (2002) a firm can choose among many alternative capital structures; issue floating-rate preferred stock, warrant, convertible bonds, caps and callers and others. However, the capital structure theory is limited to the decision to depend heavily or not on debt sources of funding, a decision which is a matter of discretion. Having different sources of long term funds creates conflict among the holders or contributors of the fund in terms of risk in their reward and eventual liquidation. The firm therefore should be thoughtful in selecting and combining the sources of funds and how to balance the needs and expectations of the fund providers and their risk. Investors have the conviction of enhancing their investment value maximize their wealth and interest. As the firm maximizes its value, investors expect same on their investment. Leverage may not be attractive to equity holders because the value of equity declines as the firm becomes leverage. The shareholder will be better off, only when the firm is able to optimize its capital structure by ensuring its good balance. There should be good earnings to pay interest on debt and with enough for equity holders. The more the debt, likely is the firm to default its contractual obligations, be insolvent and face financial distress (Ross et’al, 2002; Bodie, et’al, 2002).

This work is considering a possible departure of the capital structure theory of optimality and focus on optionality of capital structure as a discretion contingent on the prevailing needs in the life cycle of the firm (investment). Investors may consider the economic environments that affect their savings and income levels to order their scale of preferences to build rewarding portfolio. The value of the firm cannot change overnight on the bases of capital structure. The value of the firm should remain same under different capital structures. No capital structure is better or worse than any other, therefore capital structure is irrelevant. As equity holders risk increases with leverage, likewise their rewards increases as their compensation (Modigliani and Miller, 1958). Capital Structures changes and associated risk of diminution in value of firm and conflicts between equity holders, bond holders and agency may be occasioned by challenges of the firm in its operational cycle in any economic environment. However, there are persistent differences in terms of the offending variables across countries. Such specific country factors may not be portable across countries (Booth, Aivazian, Dernirguc-Kunt and Maksimovic, 2002). There are possible lapses in the capital structure theory.

Conflict of interest between creditors and shareholders stem from the nature of risk of the venture. Creditors may not want the firm to put in risky ventures than those the equity investors prefer. However, the firm can do better with debt equally or better than equity depending on other economic factors and indicators. There is causality relationship of corporate leverage including government bond leading to improvement in industrial confidence and growth in real GDP and industrial production, stock prices, inflation and short term interest rates (Bondt, 2002). Investors may want efficient use of their resources with diligent appraisal of projects and investment backed by due process to assess the profitability of the project. With no contractual obligation for payment of dividend and equity capital, management may have the tendency to take undue risk and experiment with shareholders funds to the detriment of shareholders. People with low disposable income cannot make their funds available to business with this known risk or to reckless managers who will stop at nothing but for their interest. Secondly, interest is deductible that improves the after tax income of the firm. Other non financial and behavioural instincts of avoidance of control dilution, risk propensity, experience knowledge and goals may be more important in influencing capital structure. Risk is how spread out the frequency distribution of returns on an investment instrument over a given number of years (Ross et al, 2002; Myers, 1977). It is the variances of a distribution from the mean and the standard deviation.

Causes of the variance and the standard deviation of equity returns are not established.

If all the financial instruments are operating in the same market then the major factor to consider that may cause the uncertainty and variability in returns of stocks as compared to risk free government bills and other bonds may be attitudinal and behavioural factors on the part of managers and investors of the firm. The theory of co variance, correlation and calculation of the mean are not measuring any causal phenomenon but just the relationship between two different stocks on their expected and actual returns for portfolio build up to diversify risk. It is a guide to make a choice in portfolio investment and does not provide conclusion for optimal capital structure and financial distress and possible fold up of a business. Some businesses of start-ups with limited personal savings as initial ownership capital rely on debt to thrive before engaging equity to expand and take up other opportunities in emerging markets. On that note capital structure per se may not be the appropriate measure and influence to explain choice for a particular investment vehicle or financial instrument. There are other factors that need consideration to help draw a better conclusion. The Trade off theory asserts that firms set a target debt to equity value ratio and gradually move towards it. Meaning any increase in the level of debt causes an increase in bankruptcy, financial distress and agency cost and hence decreases the firm’s value. Therefore an optimal capital structure may be reached by establishing equilibrium between advantages (tax shield) and disadvantages (financial distress and bankruptcy costs) of debt. This cannot be constant, as performance of the firm is not static in its life cycle.

Pecking Order theory assumes an information asymmetry among investors. Since investors generally have less information than insiders, common stocks would be undervalued by the market (Myers, Ross and Majluf). Firms prefer internal to external financing and debt to equity if they issue securities. The firm’s choice of capital structure is a marketing problem (Brealey and Myers, 2003). It is dependent on investors’ preferences and agency has a role to play by providing relevant information communicated with investors’ socio-cultural interest captured to attract positive psychological reaction.

Equity, common stock, represents the personal investment of the owner(s) in the business capital structure. It is called risk capital because investors assume the risk of losing their money and the responsibility to indemnify the business of its debt if the business fails. Common stock holders are classified as owners with right to vote and elect directors of the company who in turn elect corporate officers (Ross et al 2002).

Return made to shareholders is dividend which is payable at the discretion of the board of directors to declare or not declare. There is no liability or obligation to declare and pay dividend and therefore there is no default on the part of the company or be under any threat of bankruptcy. Shareholders having perpetual interest in the company with no contractual rights to receive dividend, they are exposed to greater risk of losing their investment when the firm is leveraged. Risk of investing in shares includes;

Risk of Capital Loss

This comes as a company is performing poorly or when the market perception of the company is negative. The share price may fall below the original price paid for the share, even to zero. If a company goes out of business, its shares will become untradeable and where a liquidator is appointed, shareholders are last in the list of other creditors to receive any funds that may be realised.

Volatility Risk

Share prices and their returns can be very volatile where shares may fluctuate significantly in price in short periods. This can apply to individual stocks, sectors or to the market itself.

Long term debt, another element of capital structure, is a contractual obligation on the company to pay fixed sums of money as interest to bondholders at stipulated time and the principal at maturity. Any default may lead into bankruptcy, especially company with limited assets valuable to cover the debt. The interest on the bond is an expense and is a tax deductible that may limit the level of tax liability and more after tax income. The contractual relation for routine and regular payment of interest and principal really edges and compel management to perform and achieve more than necessary to meet the debt obligation to avoid liquidation and bankruptcy.

Long term debt is repayable either as an amortization or at maturity by paying the principal as lump sum by a call. Here the contract on the debt provides the firm with the right to pay a specific amount, the call price, to retire the debt. The development of the debt capital is expected to propel business enterprises to grow, impact on national economies and have comparative advantage. Bondt (2002) observed that there is substitution between debt securities and other sources of corporate finance through financing cost differentials and of direct, that is, unrelated to price differentials. The debt capital is a preferred choice of businesses where ownership concentration is desirable particularly in weak legal environment and investor protection of interest is at stake.

From the literature investors are risk averse and they are informed in their portfolio decision by available information on their risk exposure. The theories of pecking order, co-variance, correlation and mean calculation all informed the investor about a firm’s performance and how the investor should combine securities to limit his risk in his portfolio that determines the capital structure. Capital structure then presents a picture and impression investors have on the firm and not capital structure as means of portfolio building.

3. Preference Ordering and Investors Behaviour

This section diagnoses the theory and principle of preference ordering where consumers for want of economic resources make their choices. They rank their demand for economic products in the order and priority of satisfaction or utility values. Consumers have limited resources or disposable income but have many needs to satisfy. Consumers may then rank their needs according to their preferences to achieve the highest satisfaction and utility (Eaton, et’al, 2005). Consumers will have consumption bundle made up of a specific quantities of each product in response to his interest and choice to fulfil his preference ordering (Eaton, et’al, 2005). Preference ordering ensures that consumers combine products that give them that needed satisfaction and self interest. Investors as consumers of investment assets have different types of financial securities to make choices, combine assets in similar preference ordering to meet their interest. Scarcity of resources implies lack of knowledge (Eaton, et’al, 2005), but when there is knowledge new grounds are broken to bring in more resources to make more and better choices. It is important to acknowledge that knowledge and information are key issues in making choices and preference ordering. As postulate by Davy Select (2018) investors should ensure that they fully understand any investment and the associated risks before making a decision to invest. Investors search for information according to their needs and objective of the investment. It may require of them to analyse and select information based on the type, source and timing to make their decision. Potential investors may require varying types of information and knowledge from different industries and from different establishments or recognized institutions to guide them in their decision and not just capital structure. They need to know the type of investment security to select, the quantities, from which firm and industry in order to reduce their risk. Investors have to diversify because not all investment decisions will turn out as expected, but diversification can be a key tool in managing risk (Davy Select, 2018). Investors acquiring a portfolio of varied investments across a range of asset classes; shares, bonds, cash etc, geographics and sectors, provides means to minimise the effects which poorly performing investments can have on their overall portfolio (Davy Select, 2018). The aggregate of the individual selections and their behaviour towards the firms as motivated by the available information and knowledge gained will model the capital structure and not the capital structure that influence the decision of the investor. On this note the capital structure should be an end depicting a judgment lashed out by investors on the firm based on their standard and bench marks set for the firm in accordance with the performance of the firm. If this position holds then capital structure is not a means that determines and influences the investor to make his choice but a response to the firm’s behaviour as depicted by available information contained in accounting and financial reports. As put by (Colley, Doyle, Logan & Stettinius, 2003), investors have better access to more detailed information than ever before enabling them to assess not only the performance of a company relative to peers but also the lucrative agreements between boards and CEOs, conflict of interest and host of other issues that historically have remained within the confines of the boardroom... The investor is aware of the opportunities offered by the different securities of equity and bond, however, based on the available information the investor may want to reduce his risk and improve his reward by combining assets that meet his preference. The firm has not lost anything but still has a capital structure as defined by the investor and not what the firm considers appropriate, which may be its opportunity cost. To the investor he has made the best decision out of the lot with the forgone rankings also as opportunity cost (Slavin, 2002). For arriving at the preferred choice, which is satisfying the investor’s interest, and providing the needed funds for the firm, the parties have reached their ‘Pareto optimality’, ensuring efficient utilization of economic resources (Eaton, et’al, 2005). Secondly the classic models construct the efficient frontier, to guide investors to choose a portfolio that optimize their expected utility (Livanas, 2008). The classic models subsequently allow investors to optimize their utility within the bounds of mean-variance efficient portfolios. The analysis of the riskiness of various assets, and of their relative correlations based on the classical models cannot be allowed to stand as the single testable hypothesis (Roll, 1977) and that the market portfolio is mean-variance efficient. The mean-variance efficient analysis using the firms expected returns may be flawed by the management information systems that could be manipulated and massaged for different objectives and purpose. The calculation cannot incorporate other behaviours that lack quantification. Even though financial management and analysis relies on cash flow data for its predictions the data are mostly derived from internal information systems developed and controlled by Accountants and their accounting standards. Financial statements may fail in its responsibility to provide credible information for investors and other users of financial statements, and that financial statements are not significant in making decisions (Abdulkadir, Abubakar and Danrim (2016). Therefore the mean-variance efficient analysis may limit the behavioural antecedent of the potential investor in making his preference ordering. This notwithstanding the efficient frontier line provides an insight about a firm’s performance and operational efficiencies in comparative terms as additional information to that of professionals and experts for investments decisions. It provides support and guidelines in selecting the best portfolio out of the lot possible combinations and trade-off between different investment assets to establish the capital structure of the firm. The potential investor would direct his behaviour towards selecting an investment security of an entity dependant on level of knowledge and information needs about the entity and this in turn will determine the capital structure of the firm. If this suffices then capital structure theory can manifest, hold and stand on investors understanding and behaviour towards the firm and not capital structure making the choice of who should invest in what securities of the firm. This creates a model of investors that incorporates the principles of behavioural finance, and demonstrates how the aggregate preferences of investors create equilibrium (Livanas, 2008) defining the capital structure as the final product.

4. Relevant Information for Investment Decision and Preference Ordering

Investors need information to make an informed investment decision. Strategic information may come from the financial statements which should guide most investment decision (Shaheen, 2010; Abdulkadir, et’al, 2016; Puspitaningtyas). The information provides evidence of existing facts and assertions made on the firm and its performance and position supported by underlying records (Millichamp & Taylor, 2008; Messier Jr., 2000; Whittington & Pany, 2004). The information as evidence should be relevant, adequate, valid and appropriate (Millichamp & Taylor, 2008; Messier Jr., 2000; Whittington & Pany, 2004, Spitzier, Winter & Meyer 2016) to meet the task of deciding on the investment asset to be acquired and not just any information. For information to be relevant it must relate to the assertion made (Whittington & Pany, 2004) and objective underlying the decision (Messier Jr, 2000; Shaheen, 2010; Osuala, Ugwumbaand, Osuji, Okpara, 2012). Sufficiency is the measure of the amount of the evidence gathered and appropriateness is a measure of its quality and fitness for a purpose (Millichamp & Taylor, 2008). The managers of the entity, as stewards of the owners of the company, in presenting the financial statements are making some assertions of facts (Osuala, et’al, 2012; Shaheen, 2010). They are disclosing essential information in accordance with accepted standards to meet the needs of users (Osuala, et’al 2012; Shaheen, 2010; Zuca, 2009). In the financial statements management is claiming that the individual items are correctly described, show figures which are arithmetically correct or fairly estimated, and the accounts as a whole show a true and fair view. The assertions, according to ISA 500 show; the existence or occurrence of assets and liabilities; completeness that all transactions, assets, liabilities and owners equity to be presented in the financial statements are included; rights and obligations that the company has the right to assets and obligations to pay liabilities included in the financial statement. The assertions also shows that valuation or allocation of assets, liabilities, owners equity, revenues and expenses are presented at amounts that are determined in accordance with accepted accounting principles; presentation and disclosures that the amounts described and classified in the financial statement are in accordance with accounting principles and disclosures (Millichamp & Taylor, 2008; Messier Jr., 2000; Whittington & Pany, 2004). It makes the information in the financial statement relevant and credible (Zuca, 2009, Abdulkadir, et’al, 2016). According to Zuca (2009) credibility emphasizes that the accounting information does not comprise any significant error or subjectivism but offers a faithful image of the mirrored phenomena or processes. In this case, the accounting information must be objective, reflecting the meaning and consequences of the economic events. It has to be neutral, not influencing a decision or issuing a judgment for the accomplishment of a pre-determined objective. In making these assertions management puts their integrity at stake that the financial statements and the information it represent reflects the true performance and the state of affairs of the company. The level of accuracy, truthfulness, validity of content and sufficiency of disclosures of key information on the activities of the entity should be the basis of accepting the information in the financial statement as relevant for investment decision. Disclosure of such information reduces investors’ information asymmetry (Hung, Gong, & Burke, 2015). Disclosure is ubiquitous in the financial industry (Hung, Gong, & Burke, 2015; Abdulkadir, et’al, 2016). However, studies carried on by Puspitaningtyas (ud) found small value correlation of determination suggesting insignificant relationship between accounting information and market values. It implies that the ability of accounting information to explain variations of market values is relatively low. Financial statements have failed in its responsibility to provide credible information for investors and other users of financial statements (Abdulkadir, et’al, 2016). The value and relevance of accounting information may be assessed on the fundamental analyses in changes in market prices and stock prices; predictions of future performance; value relevance of information incorporated to determine stock prices, and capture the value of information on the business and other activities (Puspitaningtyas, ud).

The audit report expressing the opinion of the auditor on the financial statement as to its trueness and fairness should attest to this to make the information in the financial statement credible and reliable. In so doing the information presented in the financial statement can be considered as relevant for investment decision making. In the absence of this investors reliance on any incredible information presented in the financial statements expose the investor to higher risk of loss of reward and any other interest in the company. Garbage information as input in any financial theory and analysis will bring out garbage results tainted and pregnant with anomalies. The garbage engages the mind emotionally to arrive at heuristic and garbage decision of preference ordering to give the firm garbage capital structure that may lead to financial distress. Sophisticated investors are generally less subject to the biases which would have caused them to make sub-optimal investment decisions, in an economic context. The implications are that the model for efficient market can be derived from investor preferences without necessitating the assumption that the portfolios offered in the first place, are necessarily on the efficient frontier.

5. The Information Driven Efficient Portfolio Model (IDEP-MODEL)

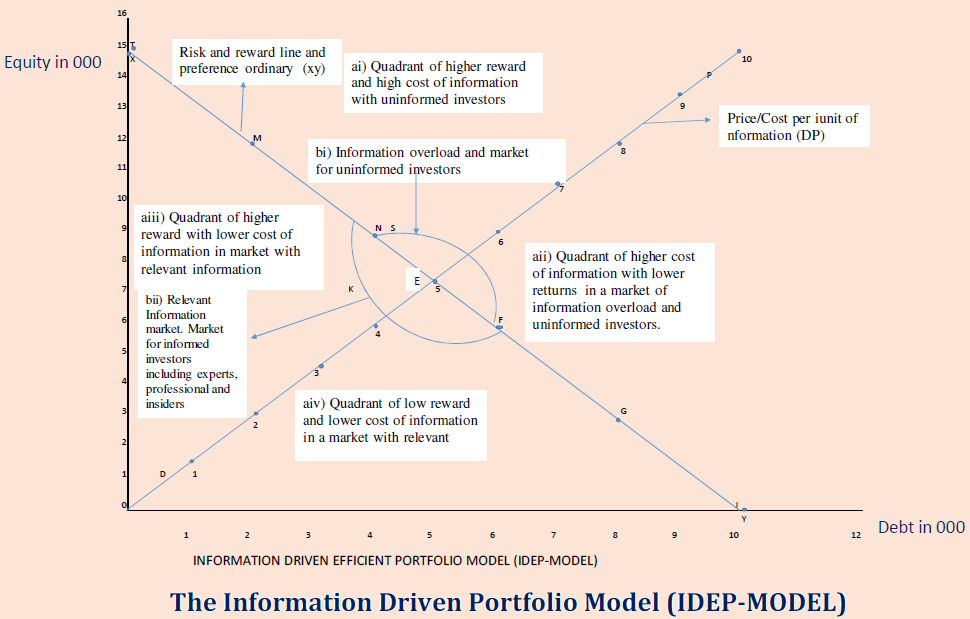

This section captures the Information Driven Efficient Portfolio Model to explain the preference ordering of investors in making investment decision on the basis of risk, reward and utility and cost of information. There are investors as professionals and insiders who are well disposed in the market and can sieve relevant information as against those investors who may lack knowledge of the financial market. It is established that investors may opt for more equity capital when there is relevant information at cheaper cost as against a situation of information overload where investors may prefer more debt to equity capital. The model shows a line/curve ‘XY’ depicting risk-reward and utility to influence investors’ choice and preference ordering. The second line/curve marked ‘DP’ is the price/cost of information. The two cures together portray the risk-reward preference ordering and cost of information relationship and their influence on choice of securities. The X-axis represents the debt security and Y-axis the equity security. When the cost of information gets higher over rewards, investors’ preference for debt security to equity gets higher. Investors will substitute equity for debt. At the point of equilibrium (E), the cost of information and returns (reward) is optimized. There are four quadrants labelled (a. i) to (a. iv) describing investors, their information type and cost.

The IDEP model shows how information and its cost and performance influence investors’ choices of portfolio.

The model depicts a market of investors of two groups and information of two types. The group of investors are professionals, experts and insiders on one side and potential investors ignorant and new in the market. Information is either relevant or overload. The professionals, experts and insiders have all the relevant information and the potential newcomers with information overload who may rely on others for direction.

There are two types of securities, Equity and Debt, making up the long term capital liability. Investors are free to make their choice of securities to build their portfolio. Investors may choose a bundle of equity and debt according to their preference and satisfaction desired. The preference is ordered in accordance with their utility (satisfaction) required, influenced by the available information on risk/reward and the price or cost to be paid.

The area beneath line XY marked ‘K’ (b. ii) is the relevant information and the area above marked ‘S’ (b. i) is the information overload.

When information is available about good equity returns, price of equity will rise and capital gains will also rise to compensate shareholders for their risk as owners. As the rewards (dividend and capital gain) are favourable, the utility value of the bundle of securities gets higher. When there is lack or loss of relevant information on the prospects of good rewards for equity, prices of shares will fall and as such investors will opt for more debt assuring them, of some fixed returns. Investors will substitute equity for debt.

The financial market therefore is information and cost driven, investors then make their preference ordering on the basis of the available information and its cost on the firm’s performance. The bundle of securities in the investors preference ordering establishes the capital structure of the firm. At point zero (0) where there is no reward and information on reward, the capital structure will have debt of 10,000 units with no equity. On the other hand when relevant information is available on the favourable reward on equity and payback within acceptable time limit (maturity), investors will take equity at 15,000 units with no debt. On this note, as relevant information on reward/risk tickle in at reasonable cost, investors choose more equity and substitute debt for equity. The cost of information line DP has relationship with reward/risk. When cost of information is lower and reward is high, investors go for equity. When the cost of information gets higher than reward, investors may trade off equity for debt. Investors choose all debt portfolios when cost of information gets higher with limited information or information overload at point ‘J’. At point of equilibrium

(E) investors give the firm capital structure of 7,500 units of equity and debt of 5,000 units. As relevant information becomes available investors substitute debt for equity. At point ‘N’ investors take equity of 9,000 units and debt of 4,000 units, substituting debt of 1,000 units for equity of 1,500 units. At point ‘M’ the capital structure is made up of 12,000 units of equity and 2,000 units of debt substituting 2,000 units of debt for 3,000 equity units. If we move from point ‘M’ to point ‘N’ in descending order, the implication is lack or lost of relevant information or reward to risk falls. Investors will then opt for more debt and substitute equity of 3,000 units for debt of 2,000 units. The capital structure will then be made up of 9,000 units of equity and 4,000 units of debt. The cost of information compared to expected reward influences the choice of portfolio. At point ‘E,’ equilibrium, the cost of information is settled at 5 units and there is optimality between costs and rewards. The investor has his optimal portfolio of optimal satisfaction and capital structure established for the firm. Cost of information and its relationship with reward and their direction in movement may influence investors’ preference ordering in different ways. From point “O” to “E” on the DP (cost) line, cost of information is below reward/risk (XY) line, covering the area marked “K” described as relevant information. The area “K” houses two quadrants; the one with high reward matching low cost (a iii) and the other with low reward matching low cost (a iv). The investor can make two possible choices of either choosing more equity than debt or more debt than equity. At a cost of 2 units the investor can choose equity at point “M” (12,000) and debt of 2,000. The investor can choose point “N” of 8,000 debt against 3,000 equity.

From point “E” to “P” has high cost above reward/risk line with an area marked “S” representing information overload for ignorant investors. The area also houses two quadrants of high cost matching high reward/risk (a i), and the one with high cost matching low reward (a ii). The investor can make two choices here as well. At cost of 8 units the investor at point “M” can choose bundles of 12,000 equity and 2,000 debts or be at point “G” to take bundles of 8,000 debts and 3,000 of equity.

This may conform to or be in semblance efficient frontier or market hypothesis, however, distinction is made of types of investors and their information availability to make their bundles of preference ordering according to their perception and cognitive psychology and their socio-cultural environment.

6. Conclusion and Recommendations

The study has the objective of understanding how information and cost, risk/reward influence investors’ behaviour in making investment choice and preference ordering as against capital structure in different environments. The bundle of equity and debt securities that make the portfolio is as a result of a behaviour orchestrating a choice that institute preference ordering in accordance with expected utility and satisfaction. It has been established that there are two groups of investors and different information sets. The professionals, expects and insiders with relevant information on the operations of the firm and the financial market. There are also potential investors, exposed to information overload, new and ignorant of the operations of the firm and the financial market. Information has cost and investors are expected to link cost of information and their expected returns in making their preference ordering of investment portfolio. In the information/cost driven market investors with relevant information will opt for more equity and less debt stocks when the cost of information is lower than reward from the investment portfolio. When the cost of information gets higher investors with relevant information will require higher reward, however, if the cost of information exceeds the reward investors will opt for more debt stock than equity. Investors with information overload experience high cost of information with high risk matching their rewards. In such situations the investor is better off to settle on more debt stock securities. The information/cost available in the financial market on the performance of the firm influence behaviour and the preference ordering of the investor and that establish the capital structure of the firm. The firm may wish for a predetermined capital structure but it is the investors’ response to information that settles the ultimate capital structure. The study has established that classical models and behavioural finance working separately to establish capital structure is given way to a situation where the two complement to determine the structure. Management of firms then have important role to play in the area of financial information provided in the market.

Information plays vital role in investors’ decision in ordering their investment portfolio that leads to the ultimate capital structure of the firm. Management should be circumspect about information made available to the public on performance and investment engagements.

Governments should strengthen the regulatory institutions that streamline financial information to meet required standards and regulations. It is imperative that such information is devoid of fraud and other material misstatements. Institutions like the Securities and Exchange Commission, Registrar General and the Auditor General should be properly resourced to carry on their mandated responsibilities of securing the relevant information for investment decisions.

There should be legislation on how to develop and manage the bond market in environments where information on the performance of the firm and financial market is weak, particularly in emerging economies with problem of mobilising capital and investors opting for debt capital.

There should be review of policies and guidelines of regulators and the Central Banks of such economies which rely on gearing in determining the liquidity and solvency positions of business firms. In environments with weak information in the financial market and poor education on investment and securities most investors go for debt capital of both short and long term. To use gearing as the bases of liquidating a business firm may be premature.

The perks and other allowances of directors of companies should not be deductions as expense but an appropriation of surplus to demand efficiency from them.